LTC Price Prediction: Will Litecoin Surge to $200 Amid Market Volatility?

#LTC

- Technical Strength: LTC trades above its 20-day MA with MACD showing reduced bearish momentum.

- Institutional Backing: Thumzup's $50M Coinbase deal underscores growing crypto adoption.

- Market Dynamics: Ethereum's performance and broader market trends may create spillover effects for LTC.

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerging

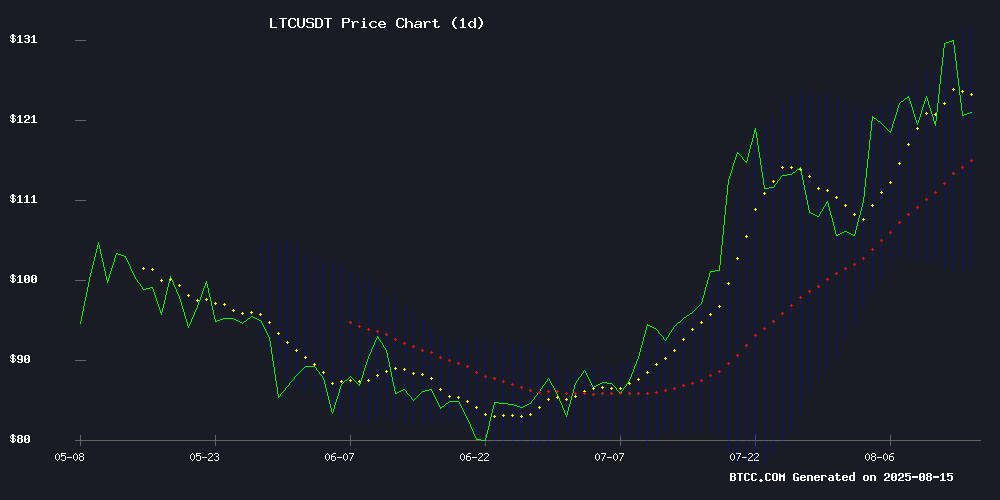

Litecoin (LTC) is currently trading at, slightly above its 20-day moving average (MA) of, indicating a potential bullish momentum. The MACD (12,26,9) shows values of,, and, suggesting weakening bearish pressure. Bollinger Bands reveal a middle band at, with upper and lower bands atand, respectively. According to BTCC financial analyst Michael, 'LTC's proximity to the upper Bollinger Band and improving MACD could signal a breakout if institutional interest aligns with technicals.'

Market Sentiment Mixed as Altcoins Face Volatility

Despite Ethereum nearing new highs, the broader crypto market has seen declines, with institutional players showing strong interest. Thumzup Media's partnership with Coinbase for ahighlights growing confidence in crypto adoption. Michael from BTCC notes, 'While headlines suggest bearish pressure, institutional inflows and strategic partnerships could stabilize LTC's price floor.'

Factors Influencing LTC’s Price

Best Altcoins to Watch as Ethereum Nears New Highs

Cryptocurrency traders are accumulating select altcoins as ethereum shows signs of another potential rally. Market veterans recognize ETH's momentum often precedes broader altcoin movements, making this a strategic accumulation phase.

Polkadot emerges as a standout despite reduced hype, with its interoperability solutions gaining traction through improved parachain auctions and developer adoption. The DOT token remains undervalued relative to its blockchain bridging capabilities, positioning it for significant upside if ETH breaks out.

Litecoin and Cardano maintain their positions as established contenders, while newcomer Remittix enters the spotlight. These assets demonstrate fundamental strengths that could capitalize on Ethereum's anticipated price action, offering traders diversified exposure to the coming market cycle.

Crypto Market Sees Broad Decline Amid Strong Institutional Interest

The cryptocurrency market faced a widespread downturn on August 15, 2025, with over 90% of the top 100 digital assets trading in the red. Bitcoin (BTC) dropped 2.4% to $119,043, while Ethereum (ETH) fell 2.3% to $4,647—erasing gains from the previous two sessions. Market capitalization slid 2.4% to $4.12 trillion despite trading volume surging to $267 billion, the highest level in days.

Institutional demand remains robust, with US spot Bitcoin ETFs recording $230.93 million inflows and Ethereum ETFs attracting $639.61 million. Regulatory clarity continues to fuel long-term optimism, with analysts projecting BTC could reach $250,000 by year-end. Short-term technical analysis suggests potential tests of either the $124,600 liquidity zone or a pullback to $115,000 support.

Altcoins suffered steeper losses, with LTC plunging 6% to $0.2307 and BSV declining 4.9% to $0.9524. Only six tokens among the top 100 posted gains during the selloff. Market sentiment shows growing caution as traders await clearer directional signals.

Thumzup Media Partners with Coinbase to Expand Crypto Holdings with $50M Investment

Thumzup Media, a Nasdaq-listed company, has secured $50 million through a secondary offering to bolster its cryptocurrency treasury and mining operations. The firm plans to acquire mining rigs and diversify its holdings with assets including XRP, BTC, ETH, SOL, LTC, USDC, and Doge. This strategic move aligns with Thumzup's ambitious target to grow its digital asset pool to $250 million, allocating up to 90% of its liquid assets to cryptocurrencies.

CEO Robert Steele emphasized the raise as a step toward a "strategically managed" digital asset treasury, with Coinbase Prime serving as custodian and prime broker. The company also disclosed a Bitcoin-backed credit facility arranged with Coinbase Prime, set for May 2025, to provide flexible capital for its treasury expansion. The $50 million will be split between mining equipment purchases and direct crypto accumulation, a high-stakes bet that could either yield steady revenue or strain cash reserves if market conditions sour.

Will LTC Price Hit 200?

LTC's path to $200 hinges on three factors:

| Factor | Current Status | Impact |

|---|---|---|

| Technical Indicators | MACD turning bullish, price above 20-day MA | Moderate upside potential |

| Institutional Interest | $50M Coinbase partnership signals confidence | Long-term support |

| Market Sentiment | Mixed (Ethereum highs vs. broad decline) | Short-term volatility |

Michael cautions, 'While $200 is plausible in 2025, traders should monitor Bollinger Band breaches and MACD crossovers for confirmation.'